Examples for the 10-year period ending January 31, 2017: By looking at the names or annual total returns for the funds below, we might expect them to be less risky.īut we can see a more complete picture by looking at the Maximum Drawdown: these funds each suffered a dramatic drop in value during the last market downturn. As you get older, you don't have the luxury of waiting and watching." A quote from a subscriber sums up the difficulty of owning a portfolio with a large maximum drawdown: "When you see 25, 30, 40% drawdown… you feel so helpless.

Caveat emptor!Īnother reason this is a feared metric: it could frighten investors.and rightly so. It took the fund about 3 years to recover from that drawdown. This is 52.2% drawdown from a fund with "Diversified" in its name. Hypothetical growth of $10,000 invested in Vanguard Diversified Equity Fund ( VDEQX) over the past 10 yearsīy looking at the graph's underlying data (available by hovering over the graph on the Vanguard website) we can see a peak value of $11,127.66 in 2007 followed by a low value of $5,318.39 in early 2009. Exhibit A (below) shows a graph that Vanguard publishes on .Įxhibit A. To be fair, the fund providers are not obscuring or hiding the data, but it's not always easy to find.Ī savvy investor needs to be aware of the Maximum Drawdown for any investment under consideration. Fund providers don't want to point out the Achilles' heel of their funds. This metric would put many mutual funds and actively managed portfolios in an unfavorable light. The "Risk Potential" ranges from 1 (low risk) to 5 (high risk). provides a sparse set of risk metrics for each mutual fund: R-Squared, Beta, and a "Risk Potential" score.'s mutual fund screener includes Sharpe ratio, standard deviation, beta, and R-squared.Additionally, standard deviation penalizes portfolios by treating downside deviation (which is bad) and upside deviation (which is good) equally.

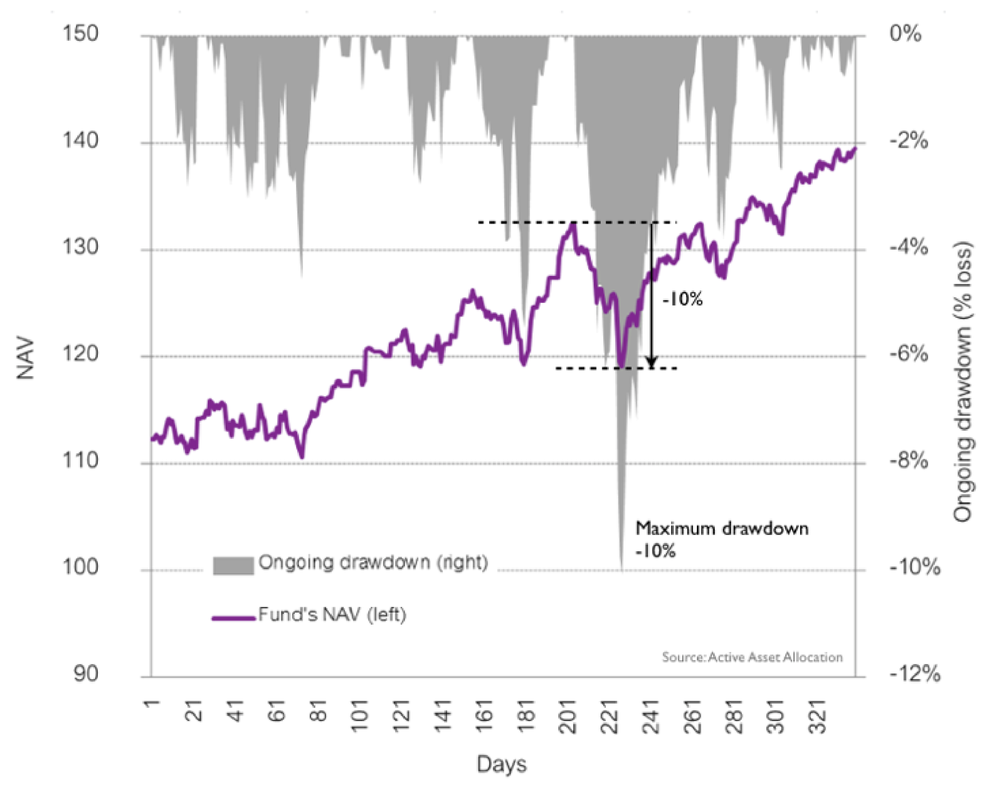

Other risk metrics like standard deviation, while popular, can average out and thereby disguise periods of poor performance. Because Maximum Drawdown is by definition "extreme," it allows investors to see the worst-case that a portfolio has suffered. In other words, it's a portfolio's greatest loss in value over the time period you're considering.įor our analysis, the Maximum Drawdown is based on the total monthly return, including distributions. "Maximum drawdown is defined as the peak-to-trough decline of an investment during a specific period and is usually quoted as a percentage of the peak value," according to the asset management firm Robeco. You can't find this metric on the websites of Morningstar, Yahoo, Vanguard, or Fidelity. This metric has the power to make a decent-looking fund or portfolio look quite dreadful. What is the metric that mutual fund providers fear?

0 kommentar(er)

0 kommentar(er)