- ADOBE CREATIVE CLOUD SUPPORT FOR TAX EXEMPT TRANSACTION HOW TO

- ADOBE CREATIVE CLOUD SUPPORT FOR TAX EXEMPT TRANSACTION UPDATE

Partners in India can view digitally signed invoices. If you are in another country or region that charges taxes, request support through Partner Center for your questions. For one-time, Azure Plan and New commerce seat-based ("G") invoices, the updated VAT % will reflect in your November 6 invoice for the period of October with no tax credits required.

ADOBE CREATIVE CLOUD SUPPORT FOR TAX EXEMPT TRANSACTION UPDATE

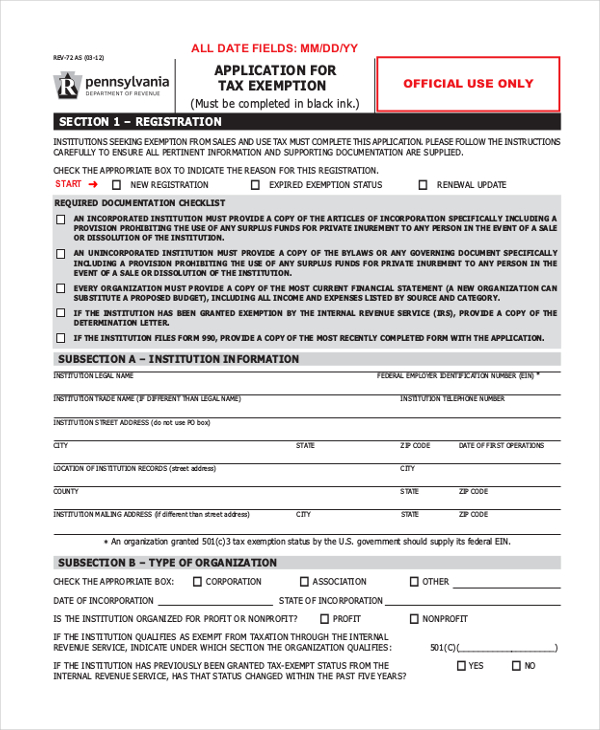

While we work to implement this change, you may pay your invoices in full, and corrections will be applied to your next future invoice in the form of tax credit.įurther notification will be sent to update you on this course of action. We're working on a solution to correct the Vatable position on your seat-based and usage-based ("D") invoices. Starting October 1, Russian Regulation states that all billing to Russian Businesses from a Foreign Company should be charged with 0% VAT. This may include resale exemption certificates that work across multiple states, such as the Streamline Sales and Use Tax Agreement Certificate of Exemption or the MTC Uniform Sales & Use Tax Exemption Certificate. Furthermore, the Puerto Rico tax is stated separately at the commonwealth and municipal level as Commonwealth Tax and Municipal Tax. Effective August 2021, the tax is stated separately on the Microsoft invoice unless otherwise noted. In the United States, including Puerto Rico, sales and use tax must be separately stated. Work with your tax advisor to determine what is relevant for your legal address and registered states. Each state has different exemption certificates for resale. Resellers in the United States who want to claim sales tax exemption must provide proof exemption within 30 days of accepting the Microsoft Reseller Agreement. Provide your BC PST#, or a completed and signed Certificate of Exemption General. The tax is displayed in two separate lines for Canada: GST/HST and PST/QST.įor a BC provincial sales tax (PST) exemption, file a tax exemption as described. Consult your tax advisor to determine whether you're qualified for exemption, and what documentation you should provide to Microsoft. Most resellers aren't exempt from goods and services tax (GST)/harmonized sales tax (HST)/Quebec sales tax (QST). For information about other countries/regions, jump to Other regions. Tax-related information for Canada and the United States is available. Work with your tax advisor to file tax exemptions based on your location and the locations of your customers.

ADOBE CREATIVE CLOUD SUPPORT FOR TAX EXEMPT TRANSACTION HOW TO

In this article, you'll find location-specific tax exemption information and learn how to view digital signatures. The rules on taxes and tax exemptions vary by country or region. As a result, Microsoft isn't always required to charge sales tax on partner invoices. The Cloud Solution Provider (CSP) program is a sales channel focused on partner resale of products.

0 kommentar(er)

0 kommentar(er)